Soar in 4 Update From Former President Martin

The FGCU Soar in 4 completion incentive program was launched in 2016. FGCU was, and is, the only institution in the State University System of Florida to offer this reward. At the time, our four-year graduation rate was about 22 percent. It appears that there was no long-term plan to finance this program, and FGCU has utilized non-state and private funding sources. Over the last few years, we have made substantial investments in student success, and our four-year graduation rate now exceeds 41 percent. As a consequence, the cost of Soar in 4 has increased markedly. This cost now effectively “taxes” funding for other programs and units on campus. Thus, we have to reconsider the future of Soar in 4.

We will recommend to the FGCU Board of Trustees that we honor our commitment to those currently pursuing their degree at FGCU. That means those who graduate in their classes of 2023, 2024 and 2025 who meet program criteria will be eligible for the incentive reward

More to follow as we assess alternatives and seek input from our board.

Should you need assistance, please email the Soar in 4 team

A Flight Plan for Graduating On Time

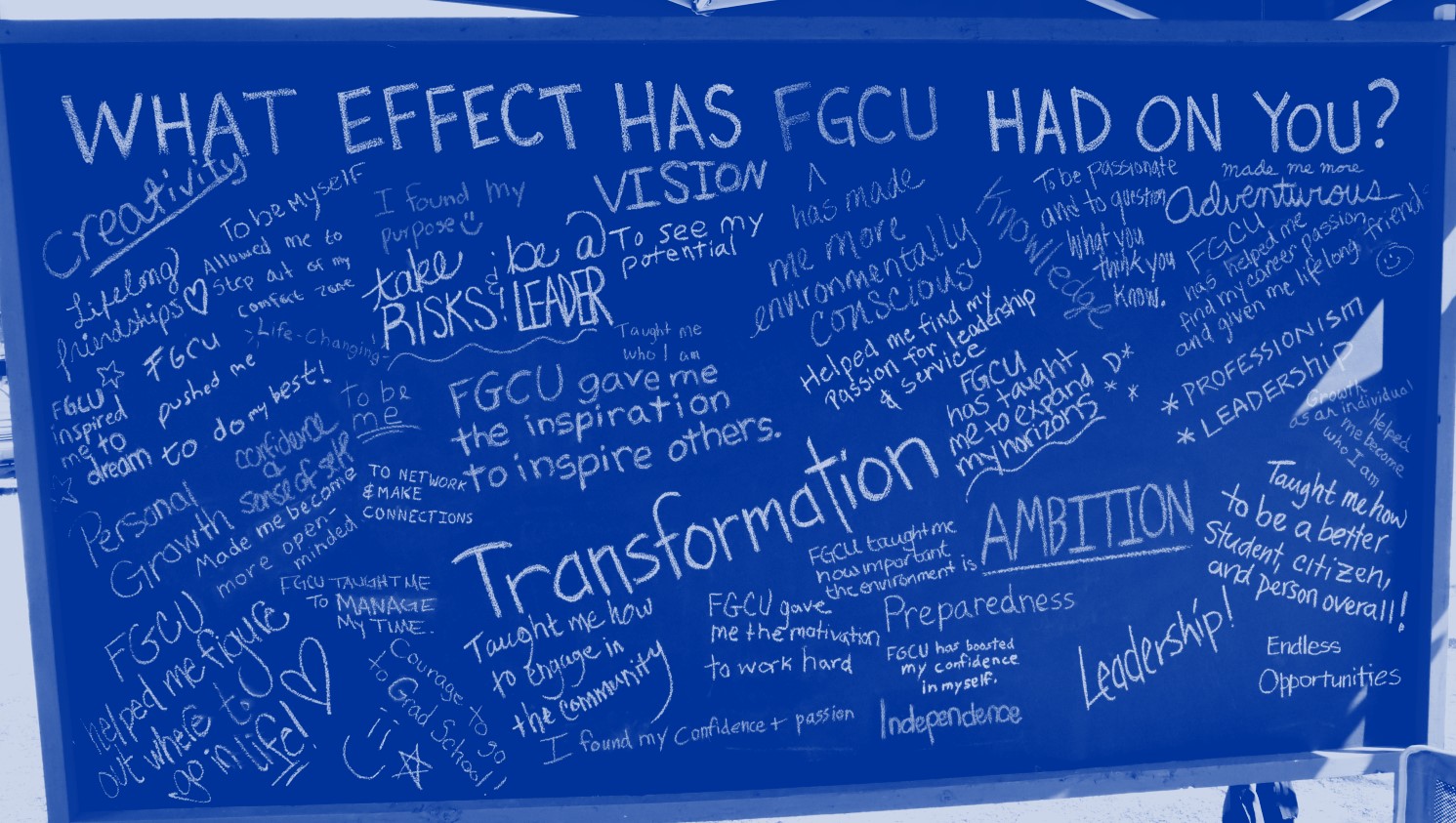

Your journey through higher education at FGCU is taking off. It’s an exciting time of scholarly exploration and self-discovery culminating at your final destination: graduation.

Even with a few diversions along the way, you can get there in 4 years or less. FGCU delivers the strategy and resources you need to make it happen, including Soar in 4. This program provides incoming first-year students an additional incentive to stay on track to a 4-year degree and secure a job: a rebate on first-year tuition. To be eligible for the rebate, be sure to complete the requirements below, and read our policy to be as informed as possible.

-

Receive Academic Advising Once a Year, Every Year

Toggle More Info -

Declare a Major During Your First Year

Toggle More Info -

Meet with Career Development Services

Toggle More Info -

Attend a Career Development Services Recruitment Event

Toggle More Info -

Complete an Internship

Toggle More Info -

Graduate in 4 Years

Toggle More Info -

Secure a Job in Florida

Toggle More Info

Ready to Submit Your Rebate Application?

Have you completed all of your Soar in 4 requirements, graduated within 4 years, and obtained a full-time job in the State of Florida earning at least $25,000 annually? If so, send an email to soarin4@fgcu.edu with the subject line "Ready to Submit Rebate Application" and explain that all the requirements have been met, include the year you entered and graduated from FGCU, your UIN and an electronic document will be sent to you to be completed. The whole process will take a couple of weeks to finalize. Students have six months to obtain a job and up to one year from graduation to submit their Rebate Application. If you would like to schedule an appointment with the Soar in 4 team use this link and someone will meet with you!

Frequently Asked Questions

-

What is Soar in 4?

Toggle More Info -

How is the Soar in 4 rebate calculated?

Toggle More Info -

Am I eligible for Soar in 4?

Toggle More Info -

What are the rebate criteria?

Toggle More Info -

Where can I find my rebate amount?

Toggle More Info -

When do I need to graduate to receive a rebate?

Toggle More Info -

I completed my internship. How can this count toward my Soar in 4 progress page?

Toggle More Info

-

How do I apply for my rebate?

Toggle More Info -

What tax form is required for the processing of the rebate?

Toggle More Info -

Will the rebate be subject to federal tax?

Toggle More Info -

What happens if my rebate application is denied?

Toggle More Info

-

What are the rebate criteria that my student must follow in order to receive their rebate?

Toggle More Info -

How can I help my student to stay on track to Soar in 4?

Toggle More Info -

Who can I reach out to with questions about Soar in 4?

Toggle More Info