Home Affordability Index

Last Updated: November 5th, 2025

About the Data

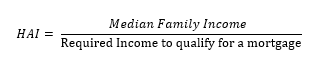

The Home Affordability Index (HAI) reflects the relationship between the median family income (MFI) in a location and the median price of a home in that same area. The index is calculated as follows:

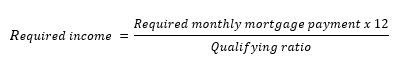

Where,

The qualifying ratio was set to be 28 percent following the 28/36 rule. The required monthly mortgage payment was computed using an 0.80 loan-to-value ratio of the quarterly median sale price for a house in each county, which was calculated using sales data from each county’s property appraisal. After subtracting the 20 percent down payment, we then calculated the monthly mortgage payments using the quarterly 30-year fixed rate mortgage rate for the U.S which was obtained from Freddie Mac. The median family income as obtained from the Federal Financial Institutions Examination Council's website.

Following the Texas Housing Affordability Index methodology, for first time home buyers’ some assumptions differ. In this case, we assumed a 0.90 loan-to-value ratio and a 0.5 percent increase in the mortgage rate due to the lower down payment. In addition, the income for a first-time homebuyer was assumed to be 65 percent of the median family income, and the home price was assumed to be 70 percent of the median price for a home.

The results can be interpreted as follows:

- HAI = 1, means the MFI is just enough to buy a median-priced home in that location.

- HAI > 1, means the MFI is greater than the income required to buy a median-priced home.

- HAI < 1, means the MFI is not enough to buy a median-priced home.

If the HAI is 1.10, it can be interpreted as if the MFI is 10 percent higher than the required income to buy a median priced home. But, if the HAI is 0.90, it suggests that the MFI is 10 percent lower than the required income to buy a median priced home.