Covid-19 and Unemployment Rate Measures

May 06, 2021 / Amir B. Ferreira Neto / Tag: Memo

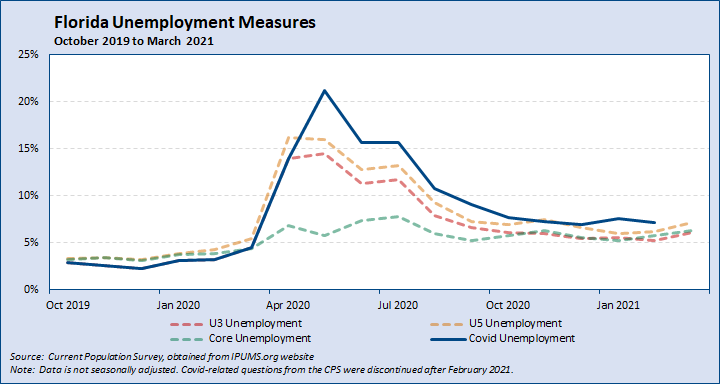

It has been over a year since state and local governments throughout the country first began implementing “lockdown” and “stay-at-home” orders. Local economies took a big hit because of these measures, especially when looking at employment numbers. With the continuing re-opening of the economy, which has been intensified with the roll-out and intake of vaccines across the country, larger attention is being paid to the labor market and the recovery of the economy. This commentary compares different measures of unemployment for the state of Florida.

First, it is important to understand what the unemployment rate is and how it is calculated. The Bureau of Labor Statistics (BLS) provides different measures of unemployment rates.1 In this commentary, we focus on two of them:

- U3 (or headline) unemployment: people who are not employed, are available to work and made at least one active effort to find a job in the last four weeks.

- U5 unemployment: U3 unemployment plus marginally attached workers. Marginally attached workers are those who want a job, are available for work and searched for a job in the last 12 months, but not in the last four weeks.

Furthermore, we introduce two additional measures of unemployment to provide further insight:

- Core unemployment: U5 unemployment minus the temporary layoffs. As Jed Kolko points, these are “permanent job losers; job leavers; people returning to or entering the labor force; and the ‘marginally attached.’”

- Covid Unemployment: U3 plus those who are unable to look for work due to Covid-19. This measure is based on a new question added to the Current Population Survey in May 2020.

The graph above shows all four unemployment rate measures for the state of Florida since the beginning of October 2019. As expected, the U5 Unemployment rate is larger than the headline (U3) measure, but both measures showed a very similar trend. Core unemployment rose during at the beginning of the pandemic, peaking at 7.8 percent in July 2020. While core unemployment has slightly decreased since July 2020, it has remained at a higher level compared to pre-pandemic figures. For example, the average core unemployment from October 2019 to March 2020 was 3.5 percent compared to 5.8 percent from October 2020 to March 2021. This pattern suggests an increase in permanent job losses in the state, thus making it important to understand in which industries this loss is happening.

The Covid-19 unemployment rate is above all U3, U5 and core. There are many possible explanations for why Covid-19 continues to affect the ability of workers to (re-) join the labor market, including less access to schools and daycares, as well as elderly care, fear of returning to work and getting sick, among others. The picture helps to illustrate that the people affected by the Covid-19 are more than the “marginally attached” workers (U5).

For a full recovery of the economy, as also discussed by Fed President Jerome Powell, it is important to bring all workers back to the labor market. The simple creation and/or re-opening of permanent positions may not be enough. Making sure people are comfortable and secure to return, as well as having the necessary support to be part of the labor market is going to be crucial.

About the Author:

Dr. Amir B. Ferriera Neto is the Interim Director for the Regional Economic Research Institute at Florida Gulf Coast University.

Related Links:

Issue Brief: Covid-19 Impact on Florida Labor Force

U.S. Bureau of Labor Statistics Unemployment Rate Concepts and Definitions

1 Visit the BLS website for more information on all the different unemployment rate measures and definitions.